VITA

Objective

“Improved livelihoods and nutrition of poor and vulnerable people".

Development Objectives

“Farm enterprises of poor and vulnerable rural people are increasingly profitable and sustainable, strengthen their market linkages and use appropriate financial services.”

Outcome 1: Improved small-scale producers’ capacities to run profitable farm enterprises and establish linkages with suppliers and buyers.

Outcome 2: Transformational increase in investment in the smallholder agricultural sector in supported programme states.

Outcome 3: Improved access by small-scale producers and clusters’ actors to productive infrastructure

Major Highlights

Project Duration

Sept 2021 to Sept 2027

Target Beneficiaries

| Province | Districts | Households | Branches | Component |

|---|---|---|---|---|

| Lumbini |

All 12 Districts (Nawalparasi West (Parasi), Banke, Bardiya, Dang, Kapilvastu, Rupandehi, Arghakhanchi, Palpa, Pyuthan, Rolpa, Gulmi, Rukum East) |

30,000 | 33 | Component 1, 2 & 3 |

| Madhesh |

All 8 Districts (Saptari, Siraha, Dhanusha, Bara, Mahottari, Sarlahi, Rautahat, Parsa) |

25,000 | 37 | Component 1 & 2 |

| Bagmati |

8 Districts out of 13 (Chitwan, MakawanpurSindhuli, Kavre, Dhading, DolakhaSindhupalchokNuwakot) |

15,000 | 20 | Component 1 & 2 |

|

SLVC2 Project |

20,000 | Component 2 | ||

| 28 Districts | 90,000 | 90 | ||

|

Other Program funded by IFAD |

30,000 |

Financial Services only |

Component 2 | |

| TOTAL | 1,20,000 |

- 530,000 household members

- 60% women and 30% youth beneficiaries

- 70,000 small-scale producers are expected to increase total real net farm income by at least 60% and a further 50,000 small-scale producer by at least 40%

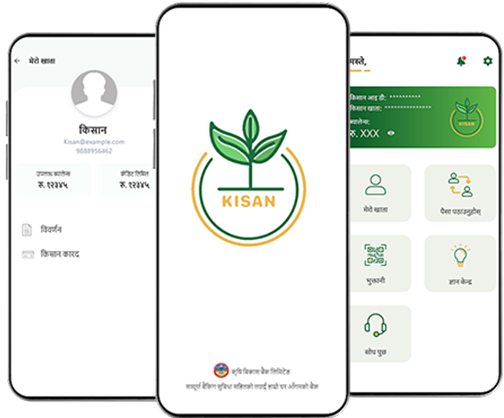

- Number Of Kisan Credit Cards and Kisan Apps disbursed by the end of the project: 120,000

Funding Agency

- International Fund for Agriculture Development (IFAD)

Supporting Agency

- The Government of Nepal (GON)

- Ministry of Finance

Implementing Institution

- Agricultural Development Bank Ltd.

- Heifer Project Nepal (HPN)

Project Description

The Value Chains for Inclusive Transformation of Agriculture (VITA) Program is a scaling-up of the successful models of inclusive rural growth that have delivered substantial impacts on net farm incomes for small-scale producers. VITA advances these best practices by bringing in the largest financier of agriculture in Nepal to the core of the program, Agricultural Development Bank Ltd (ADBL), to remove the critical constraints of access to finance for agriculture, while building climate resilience into public and private investment practices and accelerating development of digital rural financial services. It expands on the previous partnership with Heifer, a key implementing partner using their proven field approaches to further strengthen the empowerment of women and youth focusing on nutrition without additional complexity. ADBL is the Lead Program Agency (LPA) and co-financier and accountable to the Programme Steering Committee (PSC) chaired by the Ministry of Finance (MoF) and leading the implementation of all components. Heifer Project Nepal is the implementing partner and co-financier, with particular responsibilities for socio-economic mobilization and supply chain development and coordinating its network of local NGOs to deliver field level activities under the program. ADBL and Heifer Project Nepal are operating on a one program /one team basis.

VITA encourages like-minded farmers to organize themselves into producer organizations (POs) to achieve the necessary scale to better interact with buyers and service providers and increase efficiencies and competitiveness of their local supply chains. It builds awareness of climate risk and practical adaptation measures for producers. It establishes rolling cycles of multi-stakeholder platforms (MSPs) to build networks and business relationships, facilitate market linkages and encourage investment opportunities for producers and MSMEs. It provides sustained mentoring to producer groups so they can take advantages of the opportunities that emerge through the MSP processes. It promotes complementary investments by small and larger commercial service providers and cooperatives serving the clusters with direct or embedded services.

Expanding financial services to agriculture tackles supply-side constraints including systemic shortages of term finance, due to term mismatches between sources of funds and borrowers’ requirements. Financial system is sustained through a subsidiary loan to ADBL and wholesale term loans to partner financial service providers (FSPs) for on-lending to small-scale producers and MSMEs in the supported supply chains retaining consistency on small ticket size of loan.

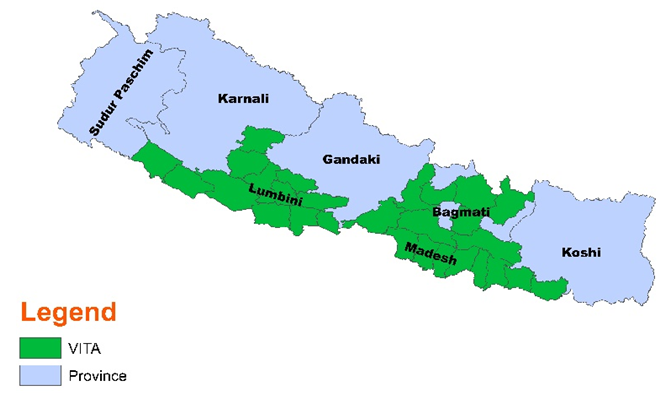

Project Area

Project Image Gallery

Expected Outcome of the Program

- Ensure financial access to all stakeholders in the agricultural supply chain.

- Increase investment opportunities (about 36 billion Nepali rupees) by improving financial capacity for business development and increasing productivity of agricultural supply chain.

- Reduce digital divide at rural level through effective digital financial services.

- Increase farmers' access to market and improve business relationships and cooperation among collectors, traders and farmers.

- Increase the productive capacity and access of market oriented infrastructures of agricultural producers and agribusinesses involved in the supply chain.

- Increase the income of farmers by 55% and return on labour by 125% through competitive and strong supply chain.

- Increase in women empowerment and involvement of youth in agriculture, and improve the sustainable institutional capacity of Agricultural Development Bank Ltd. and other partner financial institutions.

VITA Program Target Group

- Small-scale producers, including landowners and landless, and labors involved in selected supply chains& MSMEs and Producers Organizations (PO) active in supported supply chains.

- At least 60% women beneficiaries and 30% youth.

- Disadvantaged individuals including Dalits, Janjatis and other disadvantaged groups.

VITA Program Components

Component 1: Inclusive Supply Chain Development

- Mentoring and Mobilization of small-scale producers

- Business skills training to small-scale producers

- Brokering and investment facilitation

- Market information, marketing, technical assistance and facilitation of business-friendly environment, etc.

Component 2: Expanding financial services to agriculture

- Increase in access to financial services

- Loan Automation System and digital financial services.

- Enrollment of Kisan Card and Kisan Application

- Loan Product Development

- Credit Risk Management

Component 3: Supply Chains Infrastructure

- Productive and market-oriented infrastructure development (irrigation, collection center, market center etc.).

- Planning, monitoring, and evaluation

- Learning, knowledge management and Communication

- Project management

VITA Program Targeted Agricultural Commodities

Based on road corridors and clusters

Major agricultural commodities

- Vegetables

- Goat

- Fish

- Seed Potato

- Cereal Seed

- Dairy

- Banana

Additional agricultural commodities

- Citrus Fruits

- Backyard Chicken

- Coffee

- Honey

- Medicinal and Aromatic plants (MAPs)